Economics Class 28

A BRIEF OVERVIEW OF THE PREVIOUS CLASS (05:04 PM)

HOW TO HANDLE UNEMPLOYMENT (05:06 PM)

- Focus on labor-intensive sectors like Tourism, Footwear, and Textiles. [Bangladesh, Ethiopia, and Vietnam grabbed the opportunity after china shifted to high-end manufacturing]

- Focus on Skill development

- Vocational training, Job oriented training.

- Labor-intensive manufacturing sector, such as MSME.

- Focus on sunrise industries such as the Food processing sector [* Sunrise sector has a huge potential for economic growth as well as employment]

INFLATION (05:23 PM)

- It refers to the rise in general price levels in the economy over a period of time. It is nothing but, an increase in the average price level of Goods and Services in the economy.

- Inflation is measured through the price index which shows the extent to which prices have changed over time as compared to prices of the base year which is taken as standard.

- Types of Inflation

- 1) Creeping Inflation-

- It is the mildest form of inflation also known as mild or low inflation. The general price rise is low and varies between 2%-3%.

- If this rate or rise in prices continued it is considered good for the economy as the producers make reasonable profits which encourages them to invest more.

- 2) Walking Inflation

- It is also known as Trotting Inflation. In this, the price rise is more than Creeping inflation (3%-10%).

- This inflation is to be taken seriously as this is a warning for the occurrence of running or galloping inflation.

- 3) Galloping Inflation

- Inflation from more than 10% up to 50% refers to galloping inflation.

- Even foreign investors avoid such unstable economies for investment, it is also termed Running Inflation.

-

- 4) Hyper-Inflation

- It is an extreme form of inflation where the prices rise at an alarmingly high rate i.e. more than 50% every month.

- It occurs when there is a large increase in the money supply,

- In extreme situations, the value of national currency reduces to zero & the paper money becomes worthless.

- For example Zimbabwe (2009), and Venezuela (2019). In 2020 May, Iran introduced a new currency to tackle hyperinflation.

DEMAND-PULL INFLATION (05:51 PM)

- It is caused by an increase in aggregate demand and consumption due to an increase in private and government spending, a reduction in taxes, an increase in money supply and bank credit

- When there is an increase in disposable income in the hands of households, it leads to an increase in aggregate demand with no change in aggregate supply

- To check this inflation, Supply needs to be increased to match the increased demand

- Demand-Pull factors

- Increase in government expenditure or Fiscal stimulus policies leading to an increase in aggregate demand

- Rising population

- Black money can drive real estate prices, especially in urban areas.

- Extensive hoarding can also increase inflation

- Change in consumption pattern. Example- MGNREGS impact on the increase in consumption of eggs and poultry.

- Increase in real wages- Even Inflation expectations can increase prices.

- People's lack of trust in institutions and their policies can lead to increased inflation.

COST-PUSH INFLATION (06:04 PM)

- It is also called supply shock inflation. General prices rise due to the growing cost of Factors of production of Goods and services such as Land, Labor, Raw material, etc. Example- If the wage of the laborer rises then the unit cost of production also increases resulting in an increase in prices of goods and services produced. Example- In 1973, as a result of the Oil shock, there was a massive rise in general prices across the globe.

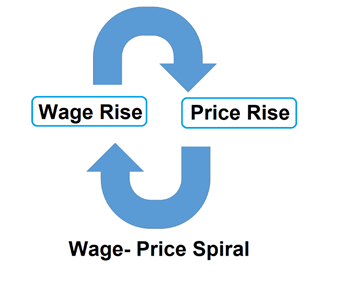

- Wage-price spiral- A rise in wages leads to demand for a rise in price. And further, a rise in prices leads to the demand for a rise in wages by the workers leading to a Wage-price spiral.

-

- Inflation expectation also leads to an increase in inflation. It also increases the cost of production.

- Cost-push inflation is also caused by an increase in indirect taxes, an increase in import prices, higher cost of capital, and interest rates.

- Other factors of inflation

- Cartelization- A group of players coming together to form a cartel. Example- In Agriculture Mandis, the traders come together and decide the prices

- Increase in administered prices of government- Increase in MSP, Diesel, and Petrol subsidies in the earlier times (Now there is no subsidy)

- Indirect taxes Such as GST and Cascading effect

- Tax Inefficiency will lead to cost-push inflation

- More middlemen will also lead to inflation

- Oil imports

STRUCTURAL INFLATION (06:14 PM)

- If Inflation persists for a longer period due to deficiencies existing in the economy such as low agricultural productivity due to inefficient distribution & storage facilities, structural problems including drought, rainfed agriculture, etc. It is also termed Bottleneck Inflation & has to be tackled through structural reforms.

IMPACT OF INFLATION (06:17 PM)

- Informal workers- Negative impact

- Bondholders or creditors or Lenders- Loose out because of inflation.

- Debtors- Inflation benefits them

- Exports- They will become non-competitive in the market. We will be interested in importing more from outside. This increases the trade deficit. It also increases the current account.

- Government's Fiscal deficit- Negative impact. More inflation means, more money will be spent by the government, thus the government has to borrow more. Also when Inflation is high, the interest rate of the banks will increase.

- Distribution of income- Poor people will be affected more. Inflation affects the poor more.

- Inflation adversely affects wage earners, Informal employees without bargaining power, and pensioners.

- Inflation impacts growth and availability of credit as it can lead to increased bond yields leading to an increase in the cost of borrowing.

- Inflation negatively impacts exports due to an increase in the cost of production.

- Inflation in the domestic economy increases imports as the imported goods may be cheaper than the domestically produced goods. This can adversely affect the current account deficit

- Adverse effect on foreign exchange- With low exports and increased imports due to inflation the demand for foreign currency increases leading to the depreciation of the domestic currency.

- Inflation can also lead to decreased savings and unequal distribution of income

- Inflation can also make borrowings of government costlier driving Fiscal deficit.

- On employment- In the short run, employment may increase with the rise in inflation (Phillips curve) however, it may not be true in the long run

- Phillips curve

- It reflects an inverse relationship between the rate of inflation and the rate of unemployment.

-

MEASUREMENT OF INFLATION (07:00 PM)

- Inflation measurement- 1) Average of 52 weeks and 2) Point-to-point method

- Wholesale Price Index

- It measures the change in wholesale prices on a monthly basis. Department of Industrial Policy and Promotion compiles and publishes WPI.

- WPI takes into account 697 commodities of various types to measure inflation but it does not take into account services.

-

- WPI uses the ex-factory prices of these commodities to measure inflation. In other words, it takes into account the prices of commodities before they reach consumers.

- The base year for WPI calculation is 2011-12

- [* Every 697 items have a different weightage]

-

- Inflation at various levels

-

- At the production level- PPI

- At the wholesale level- WPI

- At the consumer level- CPI

- GDP Deflator is the most comprehensive although it is not used for policy formulation. This data comes with a lag and thus it is not used for policymaking. GDP Deflator does not include the imported items.

- What are Base Year and Base Effect?

- The base year is the year on the basis of which we compute the inflation of an economy.

- The base effect shows the impact of the price level of the previous year or the reference year on the calculation of the Inflation rate.

- Criteria for deciding base year-

- The year with no major natural calamity, drought, or famine.

- The year should not have inflation at an alarming rate.

- Unstable years in terms of economic activity are not considered as the base year.

- There should not be many gaps between the year chosen and the current year i.e. Base year should be a recent year.

- Note- The weightage of primary articles has increased under the base year of 2011-12 whereas the Weightage of fuel and power and manufacturing has decreased.

- WPI FOOD INDEX

- To monitor food inflation more effectively DIPP started publishing the WPI Food Index in 2017.

- It measures the rate of inflation in food items at the level of producers. The aggregate of all food items within the list of 697 commodities under WPI is considered to compute the WPI food index.

HEADLINE INFLATION (07:49 PM)

- It is a raw inflation figure reported through CPI combined data. It includes both volatile and non-volatile categories.

- WPI Headline- it includes all the items in the WPI basket (100% )

CORE INFLATION (07:51 PM)

- This measure is computed by policymakers to analyze inflation data which excludes the more volatile categories like Food items, and Fuel & Power.

- Core inflation is calculated to remove the impact of temporary and short-term shocks.

REASONS FOR INCREASE IN WPI IN THE RECENT PAST (07:54 PM)

- Supply chain disruptions leading to an increase in prices of raw materials, Essential commodities, food, crude oil, Fertilizers, etc

- Excessive heat and uneven rainfall affected the farm sector

- WPI inflation is also seen as "Imported inflation" i.e. for every 1% price increase globally, WPI inflation increases at a rate of 1.63%. (Source- RBI)

The Topic for the next class:- Comparison between CPI and WPI, Divergence between CPI and WPI, GDP deflator, etc.